We’ll be answering the following questions along the way:

1.) What was the change in price of the stock over time?

2.) What was the daily return of the stock on average?

3.) What was the moving average of the various stocks?

4.) What was the correlation between different stocks'?

5.) How much value do we put at risk by investing in a particular stock?

6.) How can we attempt to predict future stock behavior? (Predicting the closing price stock price of NVDA using LSTM)

Imports and Config

!pip install -q yfinance

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

from pandas_datareader.data import DataReader

from pandas_datareader import data as pdr

import yfinance as yf

from datetime import datetime

from keras.models import Sequential

from keras.layers import Dense, LSTM

sns.set_style('whitegrid')

plt.style.use("fivethirtyeight")

%matplotlib inline

yf.pdr_override()

1. What was the change in price of the stock overtime?

# The tech stocks we'll use for this analysis

tech_list = ['AAPL', 'GOOG', 'MSFT', 'AMZN', "META", "NVDA", "TSLA"]

end = datetime.now()

start = datetime(end.year - 1, end.month, end.day)

for stock in tech_list:

globals()[stock] = yf.download(stock, start, end)

company_list = [AAPL, GOOG, MSFT, AMZN, META, NVDA, TSLA]

company_name = ["APPLE", "GOOGLE", "MICROSOFT", "AMAZON", "META", "NVIDIA", "TESLA"]

for company, com_name in zip(company_list, company_name):

company["company_name"] = com_name

df = pd.concat(company_list, axis=0)

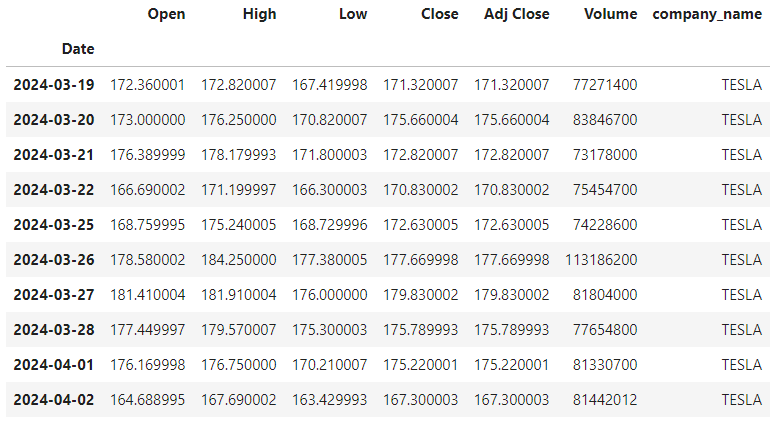

df.tail(10)

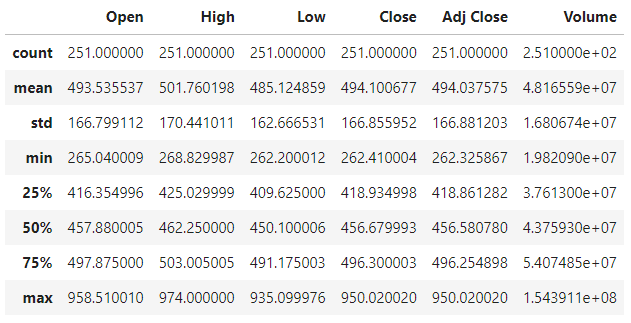

Descriptive Statistics about the Data

# Summary Stats

NVDA.describe()

Information About the Data

# General info

NVDA.info()

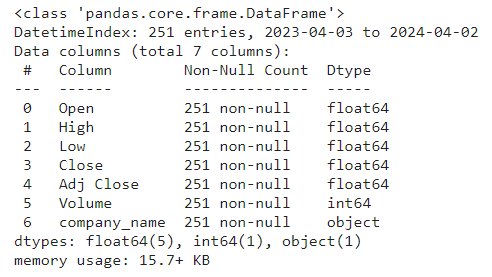

Closing Price

The closing price is the last price at which the stock is traded during the regular trading day.

plt.figure(figsize=(15, 10))

plt.subplots_adjust(top=1.25, bottom=1.2)

for i, company in enumerate(company_list, 1):

plt.subplot(3, 3, i)

company['Adj Close'].plot()

plt.ylabel('Adj Close')

plt.xlabel(None)

plt.title(f"Closing Price of {tech_list[i - 1]}")

plt.tight_layout()

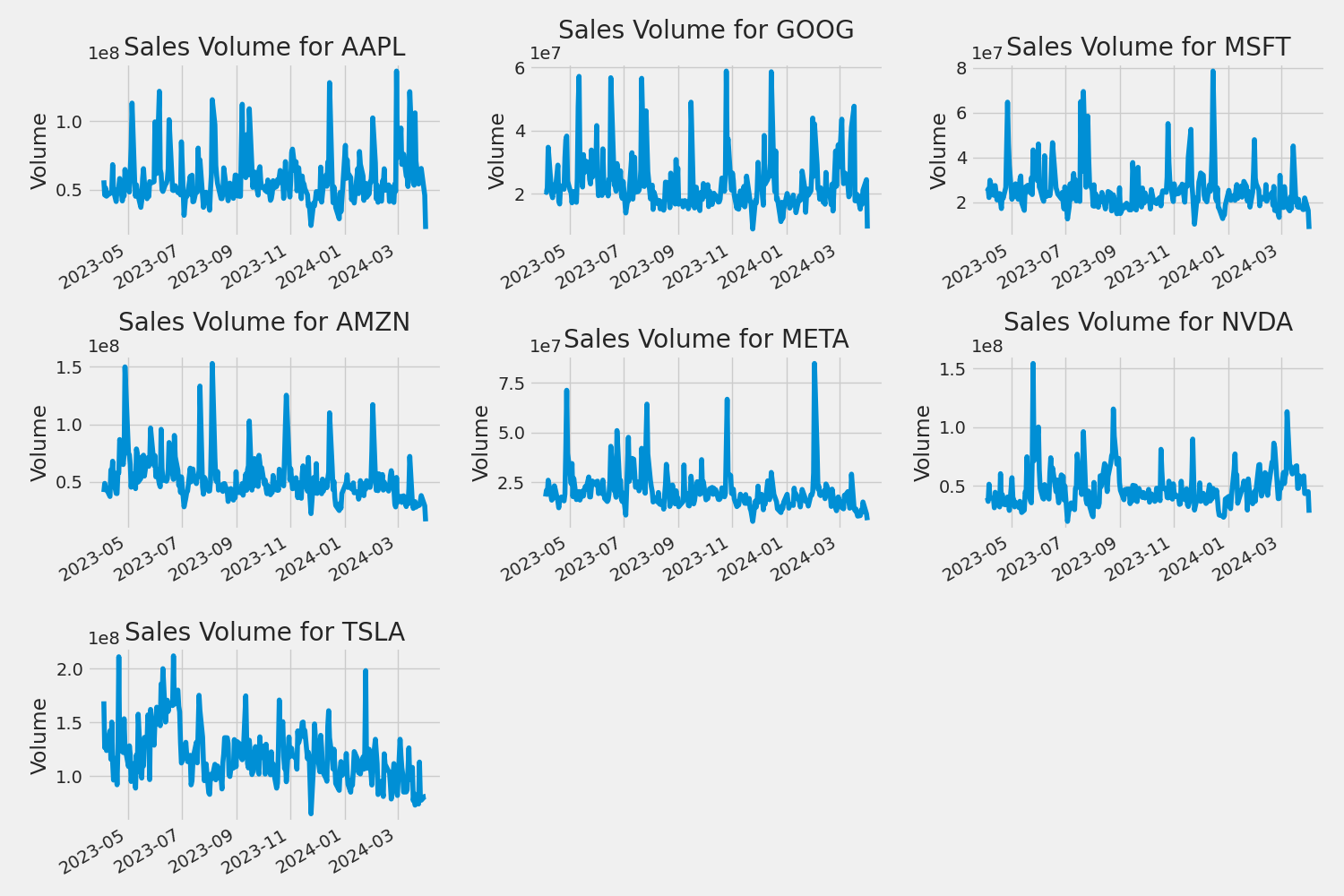

Volume of Sales

Volume is the amount of an asset or security that changes hands over some period of time, often over the course of a day.

plt.figure(figsize=(15, 10))

plt.subplots_adjust(top=1.25, bottom=1.2)

for i, company in enumerate(company_list, 1):

plt.subplot(3, 3, i)

company['Volume'].plot()

plt.ylabel('Volume')

plt.xlabel(None)

plt.title(f"Sales Volume for {tech_list[i - 1]}")

plt.tight_layout()

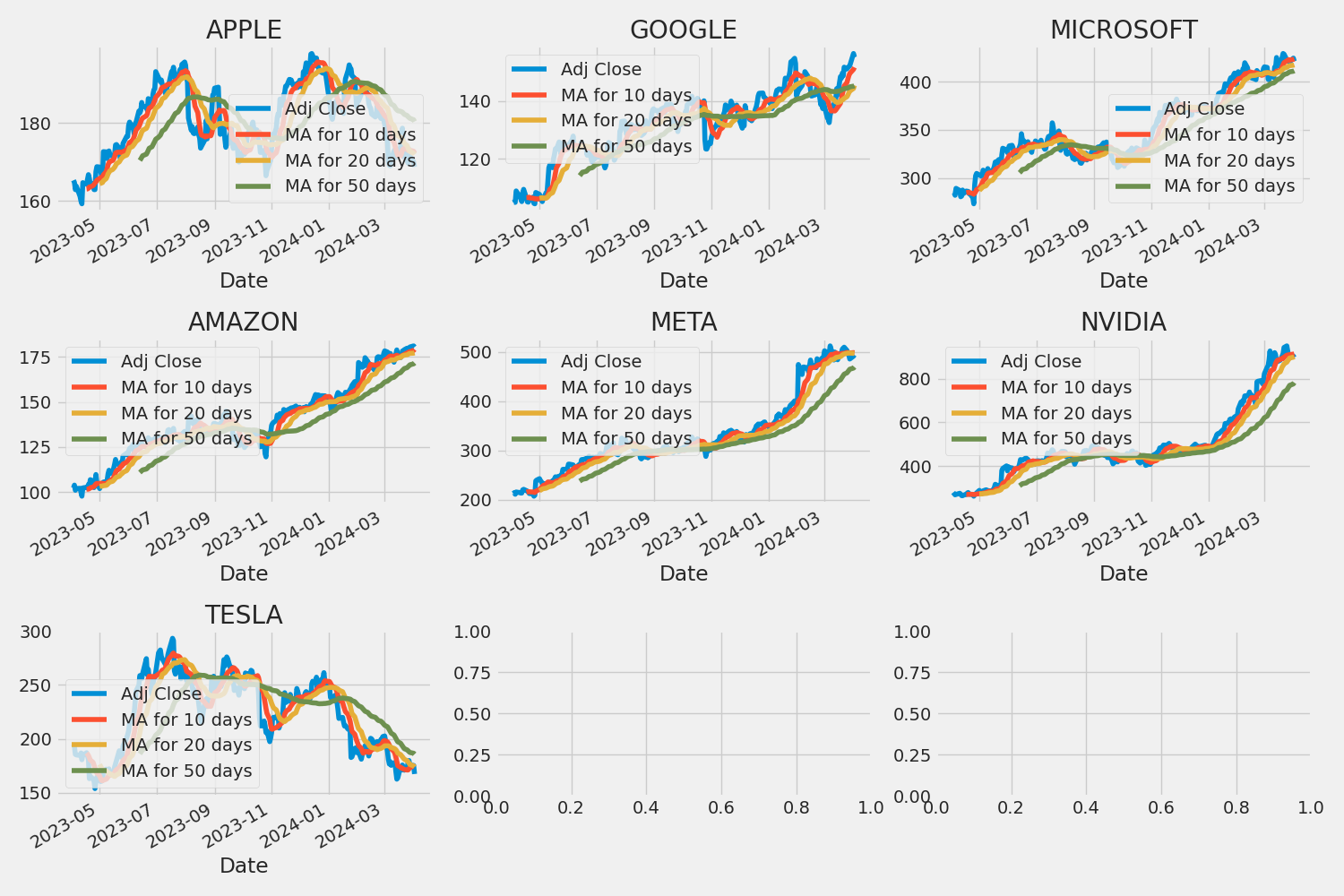

2. What was the moving average of the various stocks?

The moving average (MA) is a simple technical analysis tool that smooths out price data by creating a constantly updated average price.

ma_day = [10, 20, 50]

for ma in ma_day:

for company in company_list:

column_name = f"MA for {ma} days"

company[column_name] = company['Adj Close'].rolling(ma).mean()

fig, axes = plt.subplots(nrows=3, ncols=3)

fig.set_figheight(10)

fig.set_figwidth(15)

AAPL[['Adj Close', 'MA for 10 days', 'MA for 20 days', 'MA for 50 days']].plot(ax=axes[0,0])

axes[0,0].set_title('APPLE')

GOOG[['Adj Close', 'MA for 10 days', 'MA for 20 days', 'MA for 50 days']].plot(ax=axes[0,1])

axes[0,1].set_title('GOOGLE')

MSFT[['Adj Close', 'MA for 10 days', 'MA for 20 days', 'MA for 50 days']].plot(ax=axes[0,2])

axes[0,2].set_title('MICROSOFT')

AMZN[['Adj Close', 'MA for 10 days', 'MA for 20 days', 'MA for 50 days']].plot(ax=axes[1,0])

axes[1,0].set_title('AMAZON')

META[['Adj Close', 'MA for 10 days', 'MA for 20 days', 'MA for 50 days']].plot(ax=axes[1,1])

axes[1,1].set_title('META')

NVDA[['Adj Close', 'MA for 10 days', 'MA for 20 days', 'MA for 50 days']].plot(ax=axes[1,2])

axes[1,2].set_title('NVIDIA')

TSLA[['Adj Close', 'MA for 10 days', 'MA for 20 days', 'MA for 50 days']].plot(ax=axes[2,0])

axes[2,0].set_title('TESLA')

fig.tight_layout()

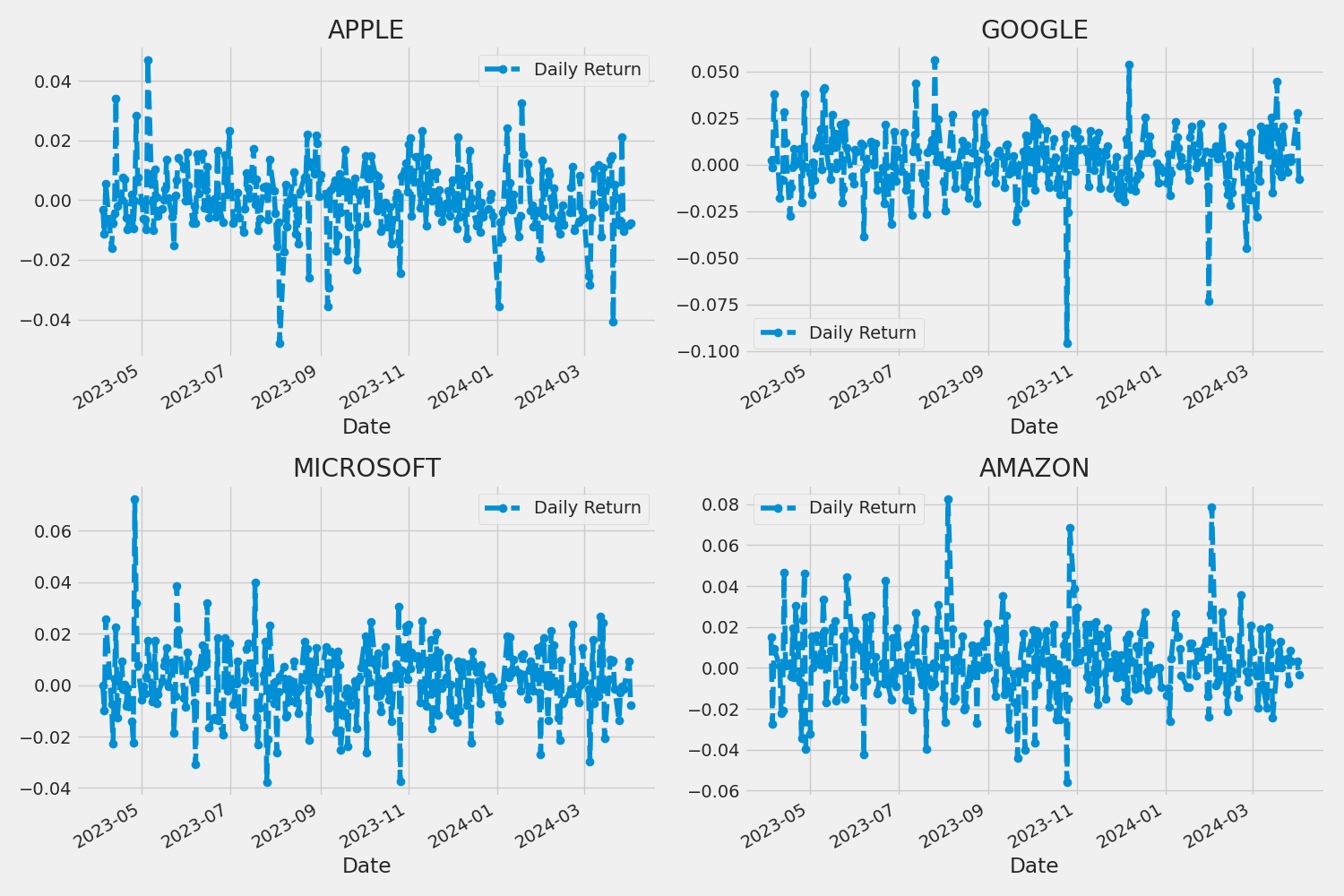

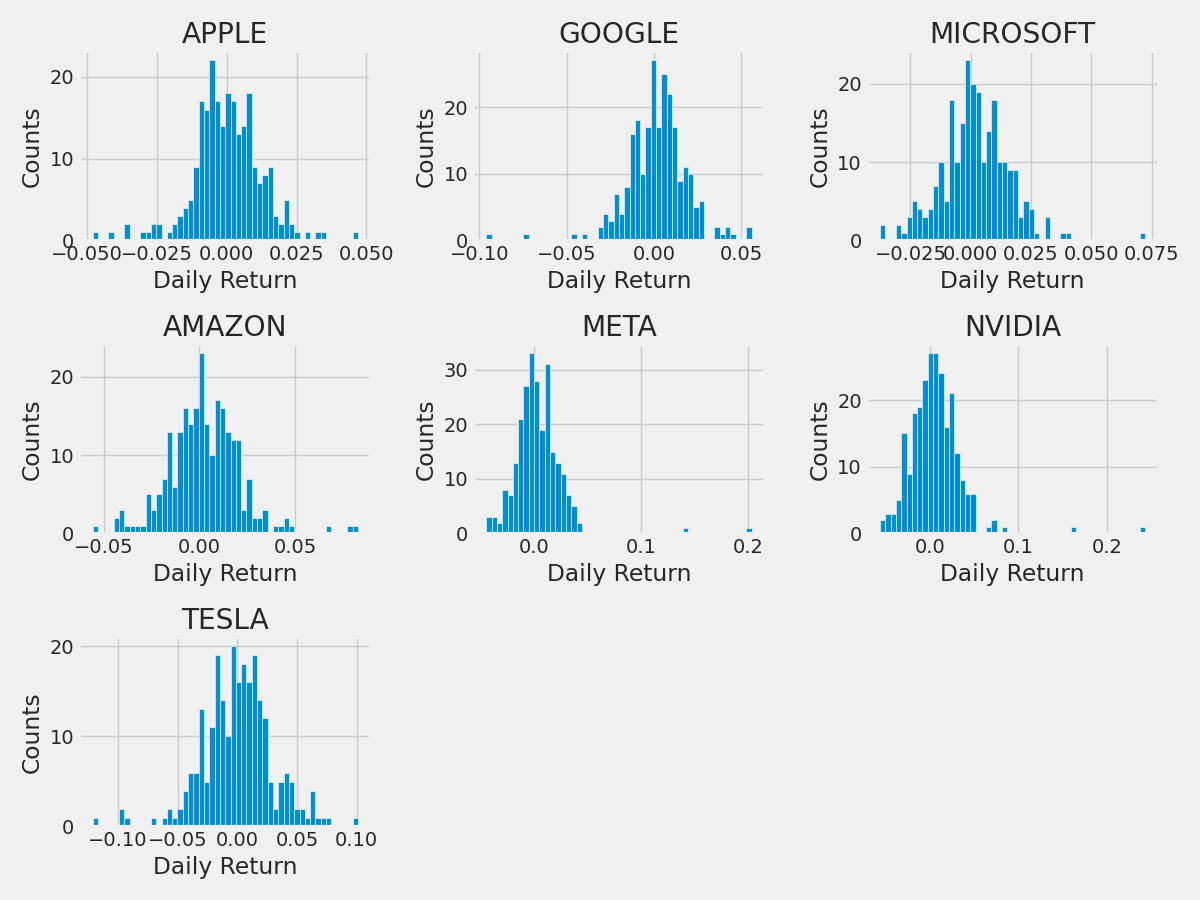

3. What was the daily return of the stock on average?

for company in company_list:

company['Daily Return'] = company['Adj Close'].pct_change()

fig, axes = plt.subplots(nrows=2, ncols=2)

fig.set_figheight(10)

fig.set_figwidth(15)

AAPL['Daily Return'].plot(ax=axes[0,0], legend=True, linestyle='--', marker='o')

axes[0,0].set_title('APPLE')

GOOG['Daily Return'].plot(ax=axes[0,1], legend=True, linestyle='--', marker='o')

axes[0,1].set_title('GOOGLE')

MSFT['Daily Return'].plot(ax=axes[1,0], legend=True, linestyle='--', marker='o')

axes[1,0].set_title('MICROSOFT')

AMZN['Daily Return'].plot(ax=axes[1,1], legend=True, linestyle='--', marker='o')

axes[1,1].set_title('AMAZON')

fig.tight_layout()

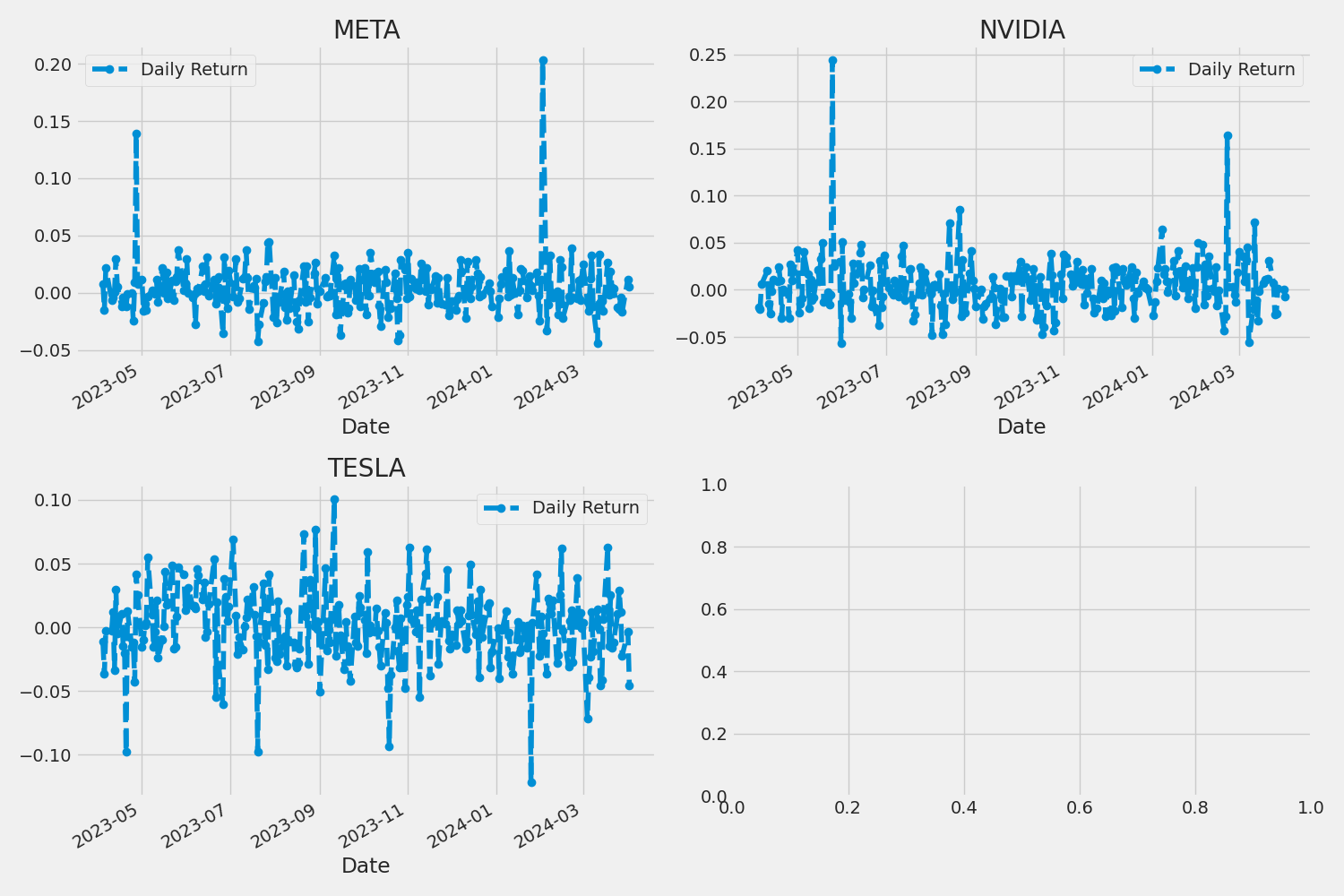

for company in company_list:

company['Daily Return'] = company['Adj Close'].pct_change()

fig, axes = plt.subplots(nrows=2, ncols=2)

fig.set_figheight(10)

fig.set_figwidth(15)

META['Daily Return'].plot(ax=axes[0,0], legend=True, linestyle='--', marker='o')

axes[0,0].set_title('META')

NVDA['Daily Return'].plot(ax=axes[0,1], legend=True, linestyle='--', marker='o')

axes[0,1].set_title('NVIDIA')

TSLA['Daily Return'].plot(ax=axes[1,0], legend=True, linestyle='--', marker='o')

axes[1,0].set_title('TESLA')

fig.tight_layout()

plt.figure(figsize=(12, 9))

for i, company in enumerate(company_list, 1):

plt.subplot(3, 3, i)

company['Daily Return'].hist(bins=50)

plt.xlabel('Daily Return')

plt.ylabel('Counts')

plt.title(f'{company_name[i - 1]}')

plt.tight_layout()

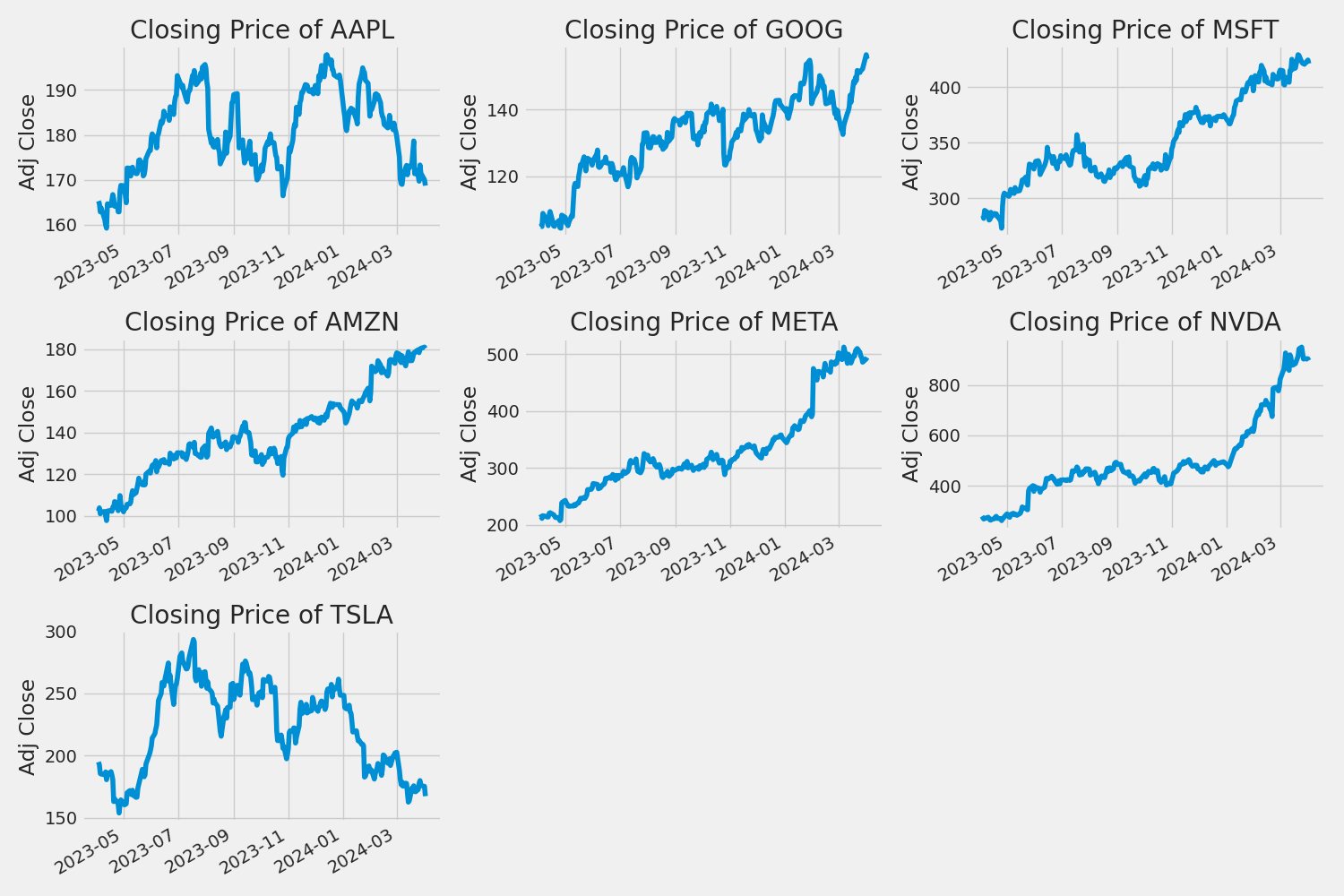

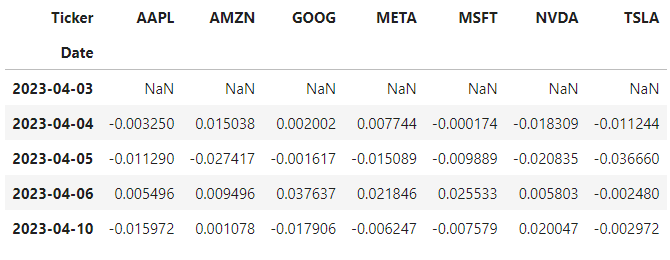

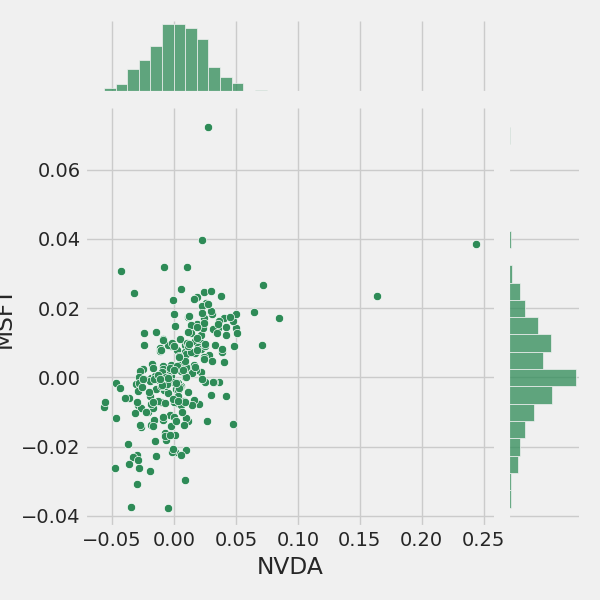

4. What was the correlation between different stocks closing prices?

closing_df = pdr.get_data_yahoo(tech_list, start=start, end=end)['Adj Close']

# Make a new tech returns DataFrame

tech_rets = closing_df.pct_change()

tech_rets.head()

Now we can compare the daily percentage return of two stocks to check how correlated. First let’s see a sotck compared to itself.

# Comparing Google to itself should show a perfectly linear relationship

sns.jointplot(x='GOOG', y='GOOG', data=tech_rets, kind='scatter')

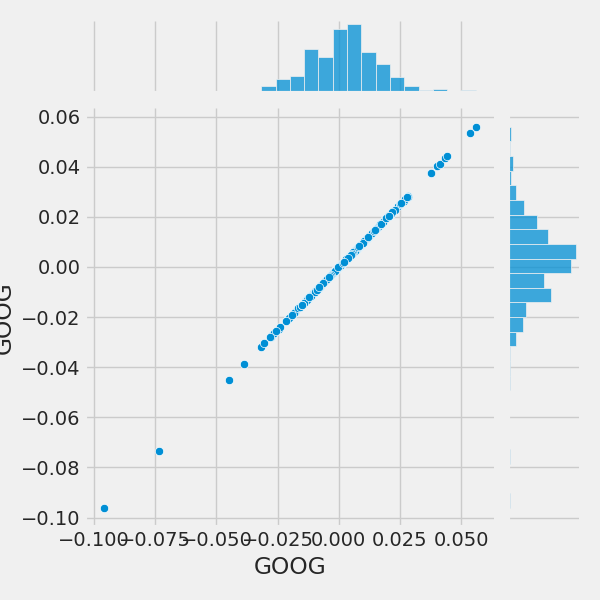

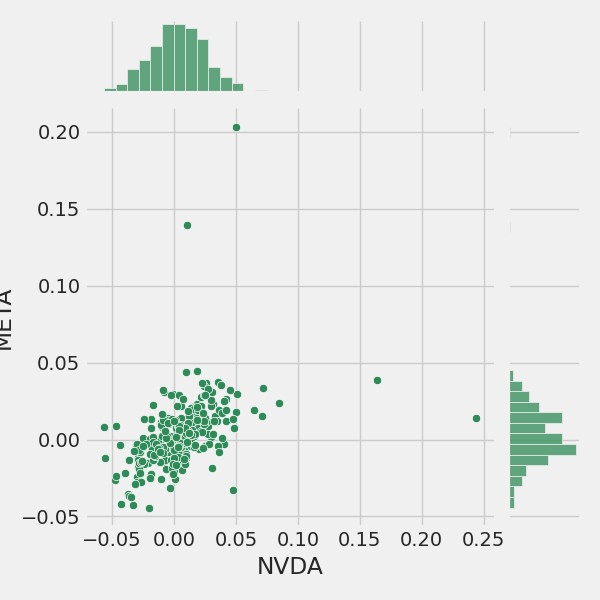

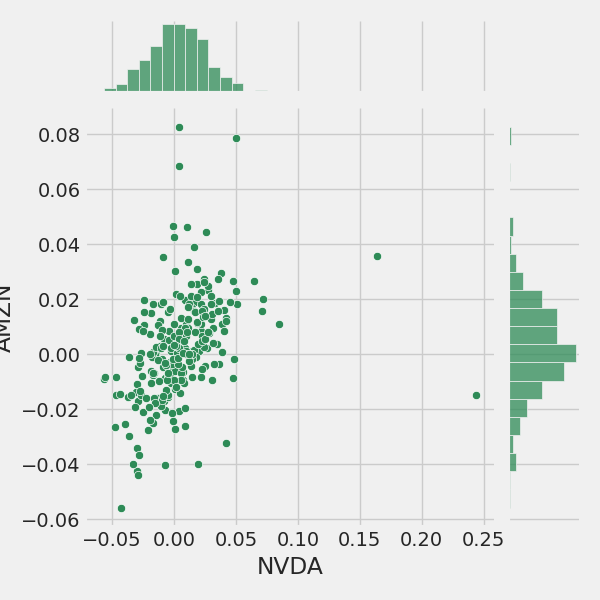

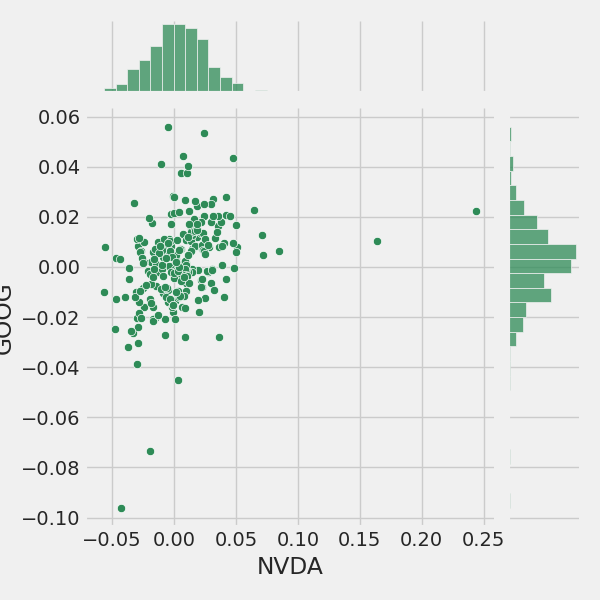

Correlation Between AI Companies and Nvidia

sns.jointplot(x='NVDA', y='MSFT', data=tech_rets, kind='scatter', color='seagreen')

sns.jointplot(x='NVDA', y='META', data=tech_rets, kind='scatter', color='seagreen')

sns.jointplot(x='NVDA', y='AMZN', data=tech_rets, kind='scatter', color='seagreen')

sns.jointplot(x='NVDA', y='GOOG', data=tech_rets, kind='scatter', color='seagreen')

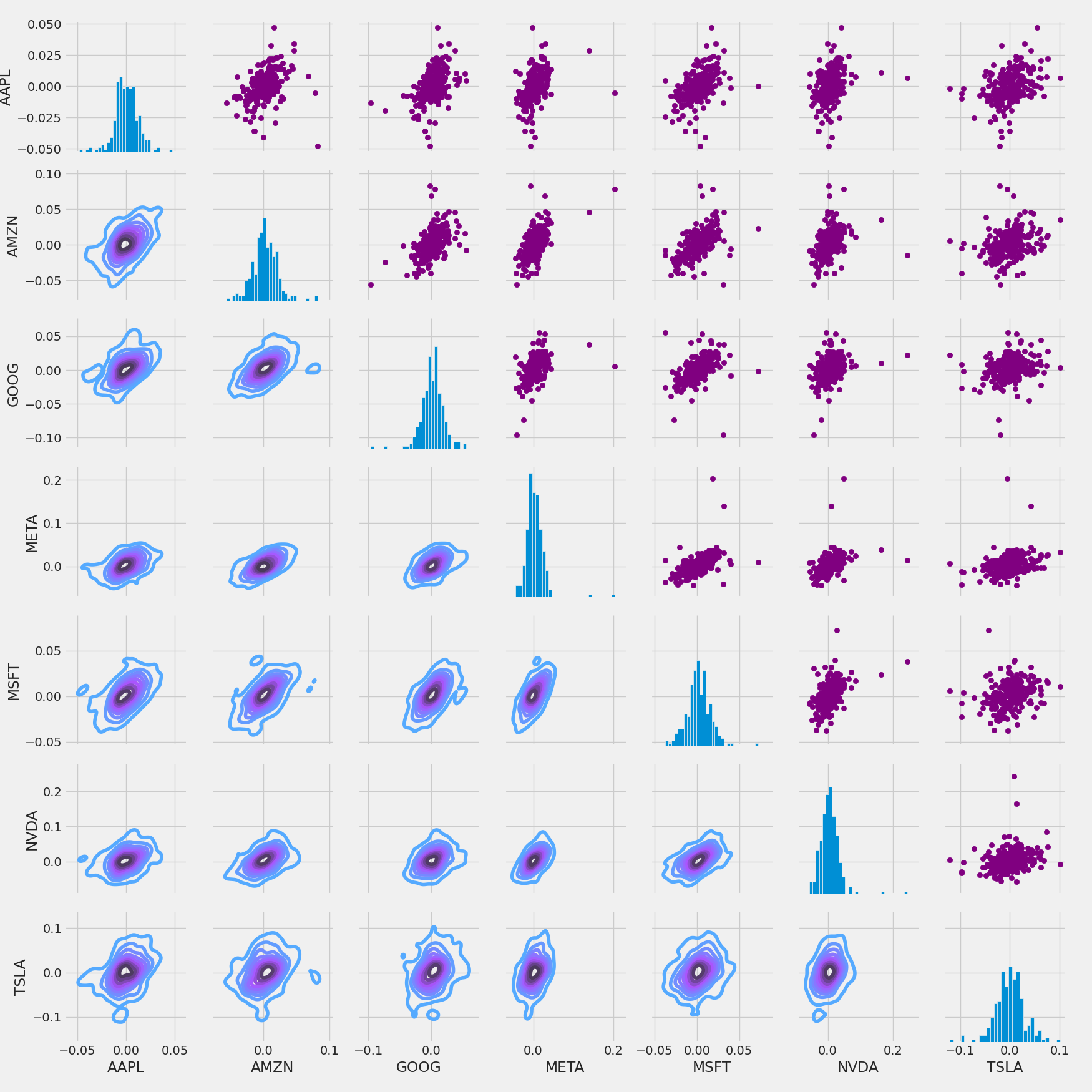

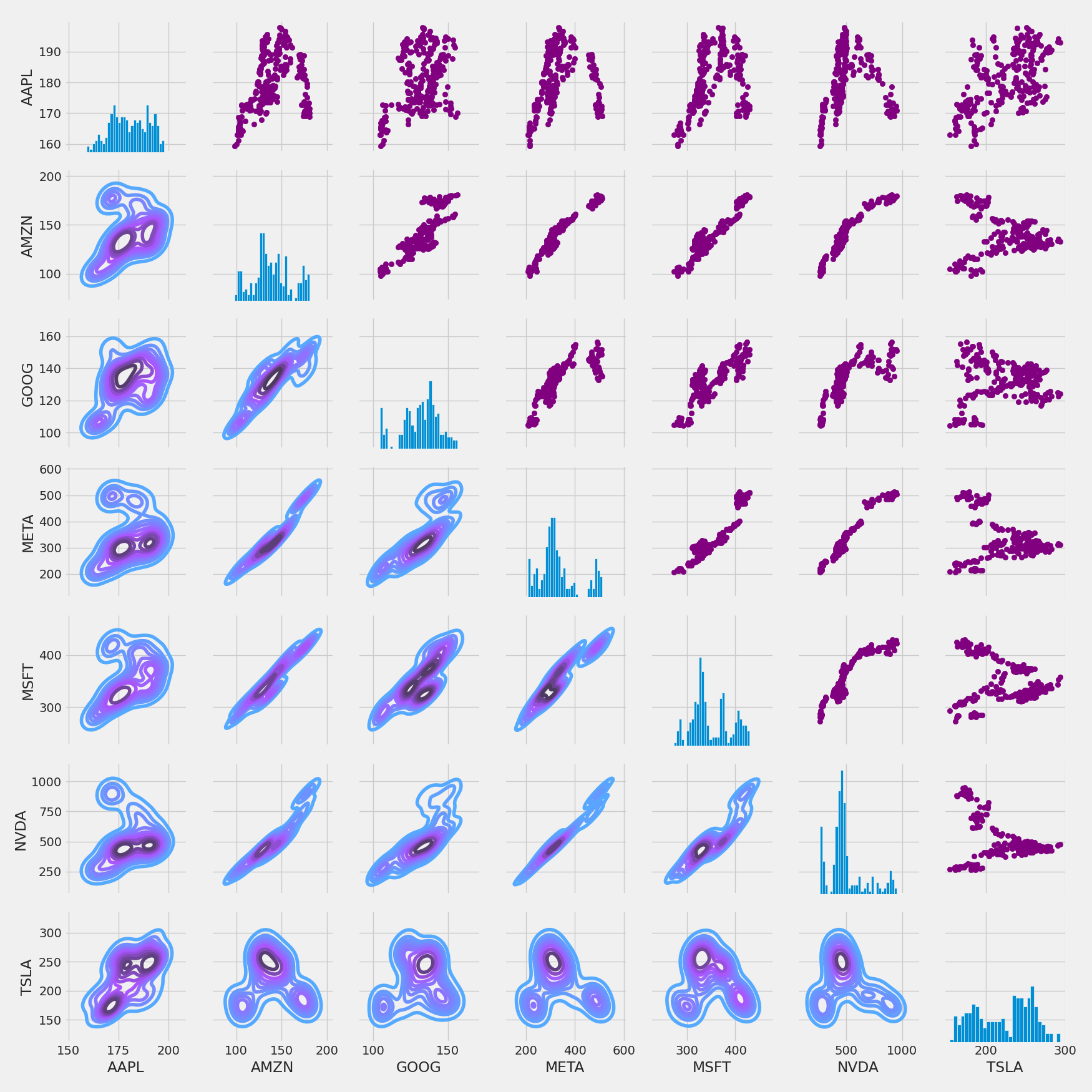

Returns Correlations

returns_fig = sns.PairGrid(tech_rets.dropna())

# Using map_upper we can specify what the upper triangle will look like.

returns_fig.map_upper(plt.scatter, color='purple')

# We can also define the lower triangle in the figure, inclufing the plot type (kde)

# or the color map (BluePurple)

returns_fig.map_lower(sns.kdeplot, cmap='cool_d')

# Finally we'll define the diagonal as a series of histogram plots of the daily return

returns_fig.map_diag(plt.hist, bins=30)

Closing Price Correlations

# Set up our figure by naming it returns_fig, call PairPLot on the DataFrame

closing_fig = sns.PairGrid(closing_df)

# Using map_upper we can specify what the upper triangle will look like.

closing_fig.map_upper(plt.scatter,color='purple')

# We can also define the lower triangle in the figure, inclufing the plot type (kde) or the color map (BluePurple)

closing_fig.map_lower(sns.kdeplot,cmap='cool_d')

# Finally we'll define the diagonal as a series of histogram plots of the daily return

closing_fig.map_diag(plt.hist,bins=30)

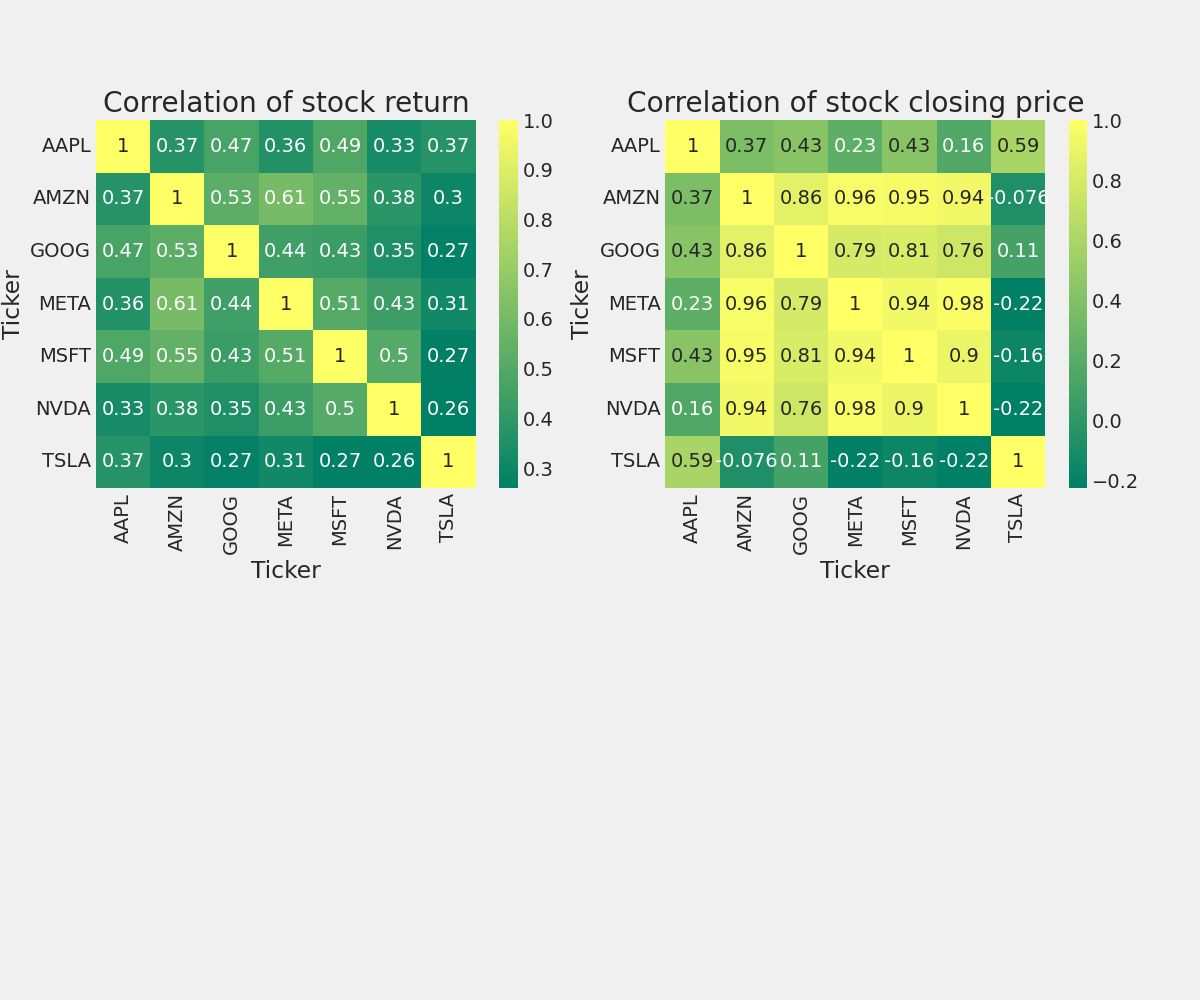

Correlation Matrix

plt.figure(figsize=(12, 10))

plt.subplot(2, 2, 1)

sns.heatmap(tech_rets.corr(), annot=True, cmap='summer')

plt.title('Correlation of stock return')

plt.subplot(2, 2, 2)

sns.heatmap(closing_df.corr(), annot=True, cmap='summer')

plt.title('Correlation of stock closing price')

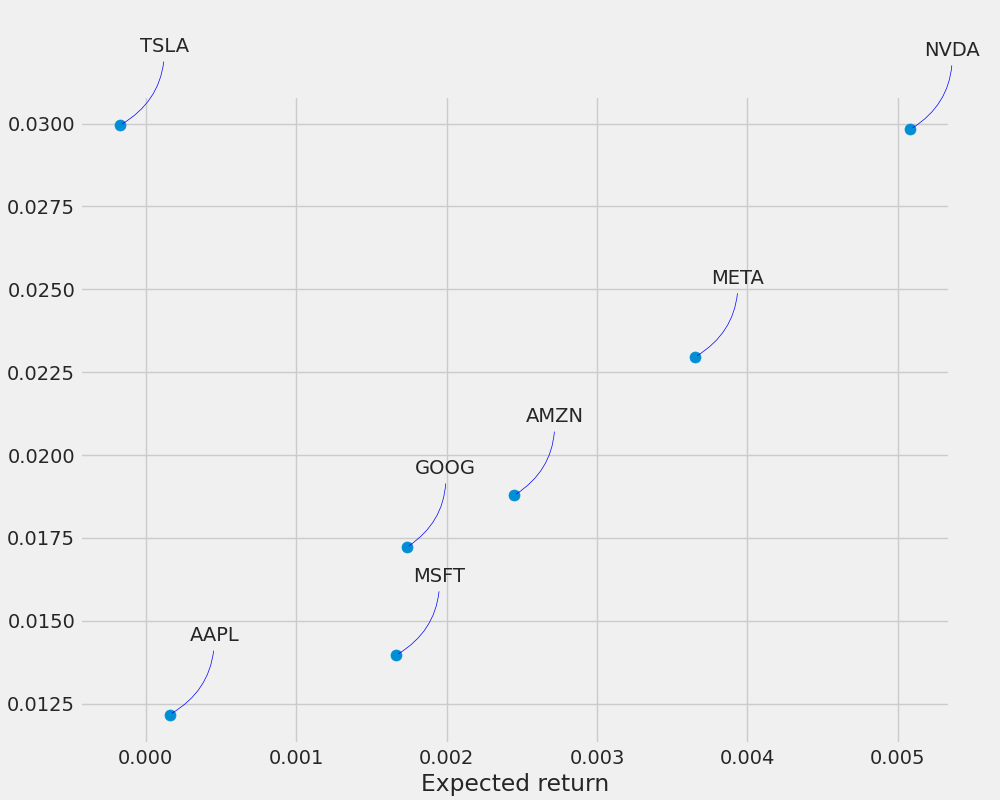

5. How much value do we put at risk by investing in a particular stock?

There are many ways we can quantify risk, one of the most basic ways using the information we’ve gathered on daily percentage returns is by comparing the expected return with the standard deviation of the daily returns.

rets = tech_rets.dropna()

area = np.pi * 20

plt.figure(figsize=(10, 8))

plt.scatter(rets.mean(), rets.std(), s=area)

plt.xlabel('Expected return')

plt.ylabel('Risk')

for label, x, y in zip(rets.columns, rets.mean(), rets.std()):

plt.annotate(label, xy=(x, y), xytext=(50, 50), textcoords='offset points', ha='right', va='bottom',

arrowprops=dict(arrowstyle='-', color='blue', connectionstyle='arc3,rad=-0.3'))

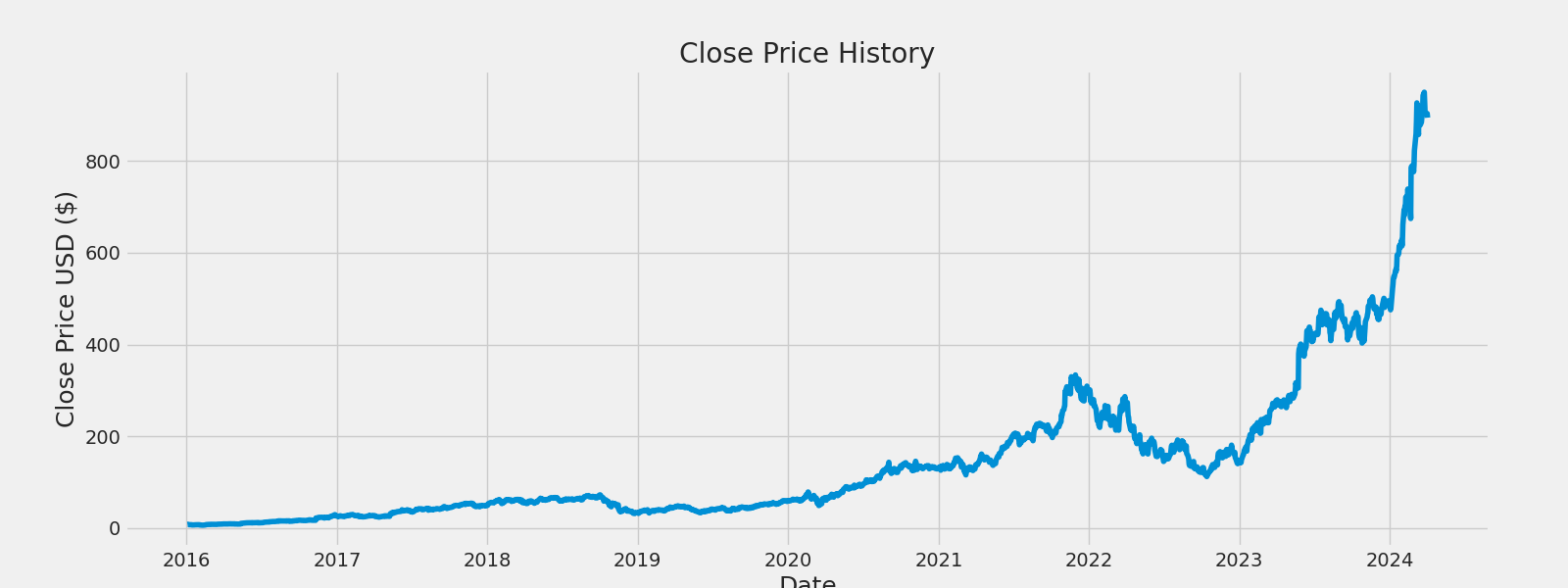

6. Predicting the closing price stock price of NVDA:

df = pdr.get_data_yahoo('NVDA', start='2016-01-01', end=datetime.now())

df

plt.figure(figsize=(16,6))

plt.title('Close Price History')

plt.plot(df['Close'])

plt.xlabel('Date', fontsize=18)

plt.ylabel('Close Price USD ($)', fontsize=18)

plt.show()

# Create a new dataframe with only the 'Close column

data = df.filter(['Close'])

# Convert the dataframe to a numpy array

dataset = data.values

# Get the number of rows to train the model on

training_data_len = int(np.ceil( len(dataset) * .95 ))

training_data_len

1972

# Scale the data

from sklearn.preprocessing import MinMaxScaler

scaler = MinMaxScaler(feature_range=(0,1))

scaled_data = scaler.fit_transform(dataset)

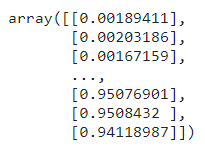

scaled_data

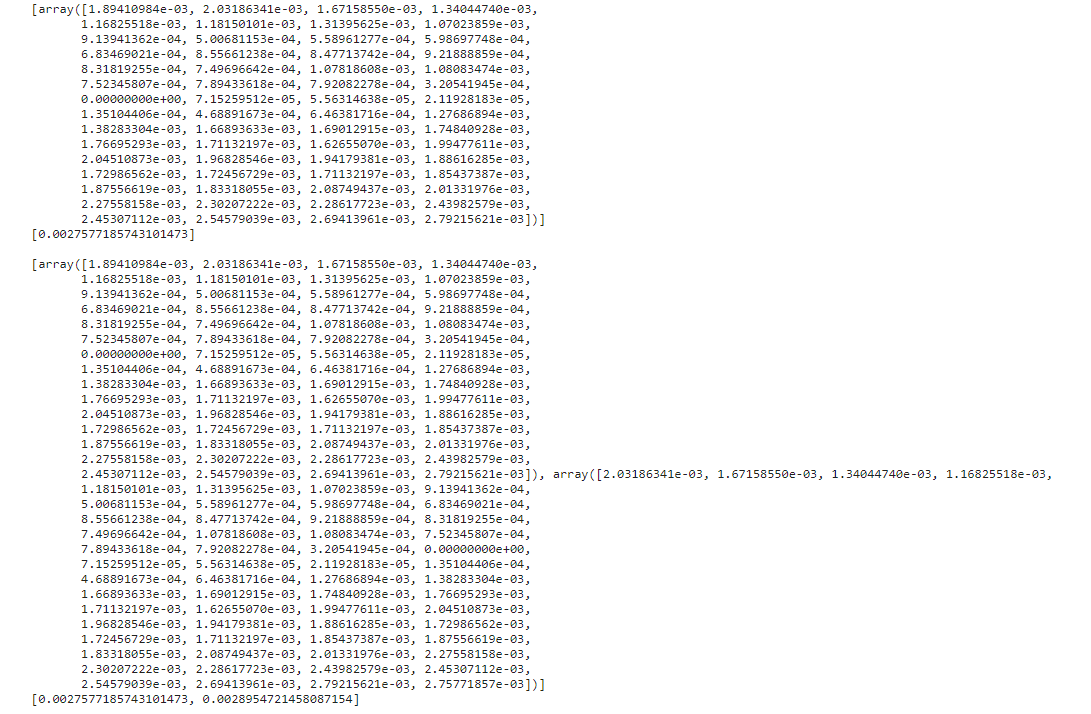

train_data = scaled_data[0:int(training_data_len), :]

# Split the data into x_train and y_train data sets

x_train = []

y_train = []

for i in range(60, len(train_data)):

x_train.append(train_data[i-60:i, 0])

y_train.append(train_data[i, 0])

if i<= 61:

print(x_train)

print(y_train)

print()

# Convert the x_train and y_train to numpy arrays

x_train, y_train = np.array(x_train), np.array(y_train)

# Reshape the data

x_train = np.reshape(x_train, (x_train.shape[0], x_train.shape[1], 1))

# Build the LSTM model

model = Sequential()

model.add(LSTM(128, return_sequences=True, input_shape= (x_train.shape[1], 1)))

model.add(LSTM(64, return_sequences=False))

model.add(Dense(25))

model.add(Dense(1))

# Compile the model

model.compile(optimizer='adam', loss='mean_squared_error')

# Train the model

model.fit(x_train, y_train, batch_size=1, epochs=1)

# Create the testing data set

# Create a new array containing scaled values from index 1543 to 2002

test_data = scaled_data[training_data_len - 60: , :]

# Create the data sets x_test and y_test

x_test = []

y_test = dataset[training_data_len:, :]

for i in range(60, len(test_data)):

x_test.append(test_data[i-60:i, 0])

# Convert the data to a numpy array

x_test = np.array(x_test)

# Reshape the data

x_test = np.reshape(x_test, (x_test.shape[0], x_test.shape[1], 1 ))

# Get the models predicted price values

predictions = model.predict(x_test)

predictions = scaler.inverse_transform(predictions)

# Get the root mean squared error (RMSE)

rmse = np.sqrt(np.mean(((predictions - y_test) ** 2)))

rmse

84.16346414984457

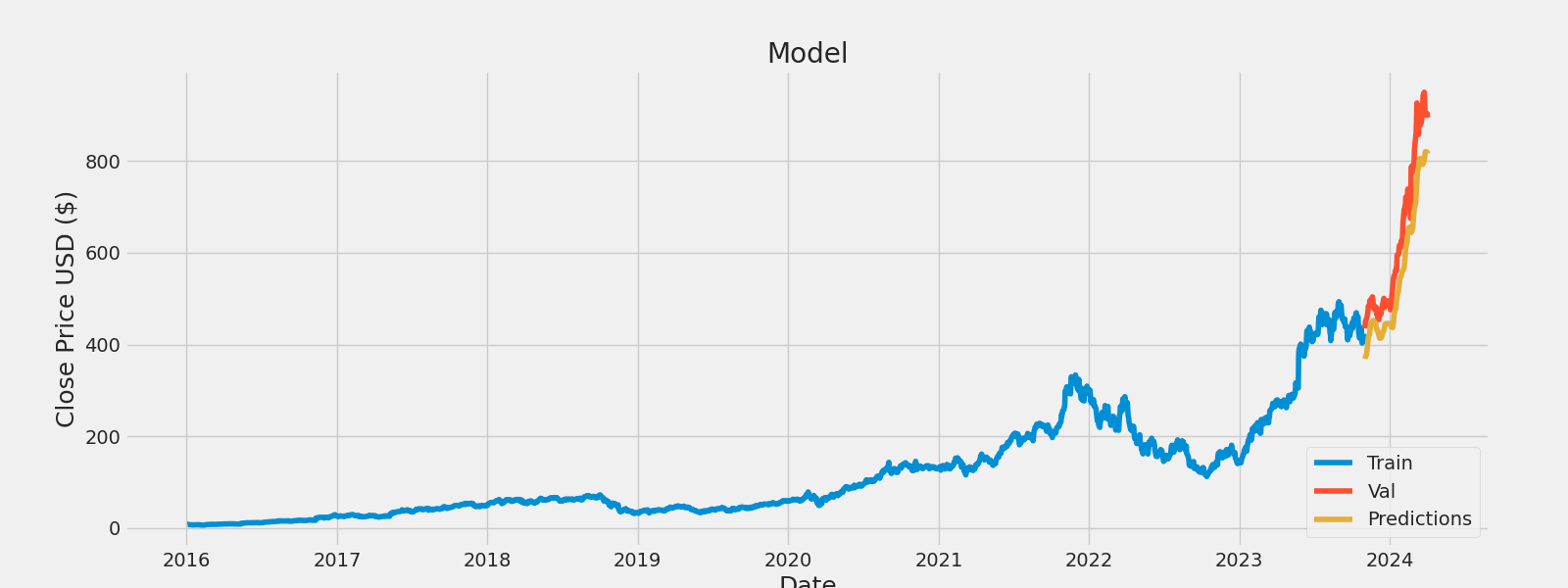

# Plot the data

train = data[:training_data_len]

valid = data[training_data_len:]

valid['Predictions'] = predictions

# Visualize the data

plt.figure(figsize=(16,6))

plt.title('Model')

plt.xlabel('Date', fontsize=18)

plt.ylabel('Close Price USD ($)', fontsize=18)

plt.plot(train['Close'])

plt.plot(valid[['Close', 'Predictions']])

plt.legend(['Train', 'Val', 'Predictions'], loc='lower right')

plt.show()

Predicting the exact value of a stock is challenging due to unpredictable market factors and information delays, making such predictions often outdated. Instead, forecasting the general direction of a stock, whether it will rise or fall, proves more reliable, considering the inherent uncertainties in market movements and providing valuable insights for investors.